insurance

Bipartisan Insurance Committee forum finds a lot of consensus on potential reforms

Download the CTHPP presentation Yesterday the Chairs and Ranking Members of the Insurance Committee convened a forum on potential reforms to lower healthcare costs. Legislators invited David Seltz from the Massachusetts Health Policy Commission. Connecticut speakers included representatives from the insurance industry, providers, state officials, a foundation and advocates. A recurring theme was the need…

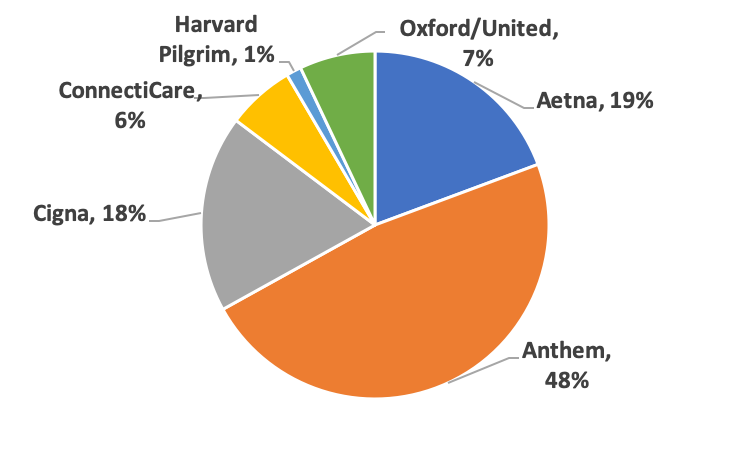

Read MoreCT insurers lost enrollment in 2018, Spent 89% of premiums on medical care

There were 332,015 fewer Connecticut residents with commercial insurance coverage last year than in 2017, according to the latest Consumer Report Card from the CT Insurance Department. All insurers lost enrollment. The report also includes important information for consumers including member satisfaction performance, numbers of participating providers by county, medical measures such as cancer screens,…

Read MoreCT healthcare price variation varies

Prices vary by city and for selected healthcare treatments, in some cases substantially, according to Healthscore CT, using the new All Payer Claims Database from the CT Office of Health Strategy and UConn Analytics and Information Management Solutions. The site provides important information on cost and quality for consumers and payers shopping for healthcare services…

Read MoreIf the ACA is overturned, one in four Connecticut adults could lose coverage due to a pre-existing condition

A new report from the Kaiser Family Foundation estimates that 529,000 non-elderly adults (24%) in Connecticut have pre-existing health conditions that could affect their ability to get or afford health insurance if the Affordable Care Act (ACA) is overturned. Researchers estimate that 27% of non-elderly adult Americans have a health condition and 45% of families…

Read MoreCTNJ: CT’s uninsured rate is down and stable, so who’s still uninsured?

According to the latest numbers from the US Census, 187,000 Connecticut residents or one in twenty of us, were uninsured last year. That’s both good and bad news. Read more

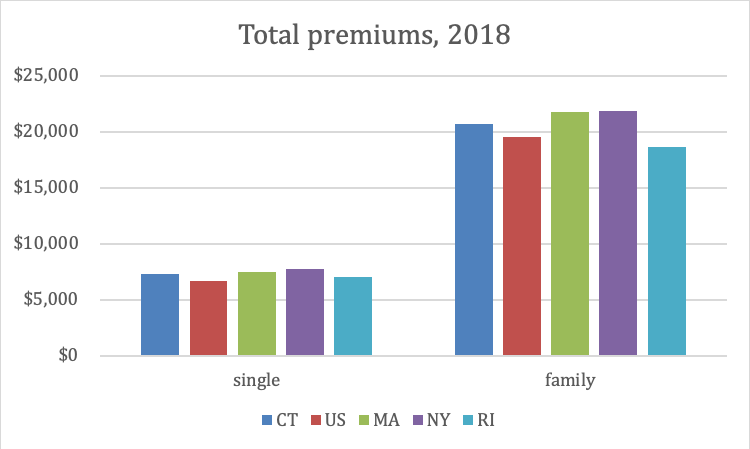

Read MoreConnecticut deductibles are high and rising, but premiums are rising more slowly

Download the report New numbers from the 2018 US Medical Expenditure Panel Survey finds that deductibles for private-sector health insurance in Connecticut are high at $2,322 for single coverage and $3,784 for families, the 3rd and 9th highest among states respectively. Deductibles more than doubled between 2008 and 2018 both in Connecticut and the nation.…

Read MoreConnecticut’s uninsured rate stabilizes, retaining ACA gains

Download the report New numbers from the US Census Bureau report that 187,000 or 5.3% of Connecticut residents were uninsured last year. That number is down slightly from the year before when the uninsured rate was 5.5%, but above 2016’s rate at 4.9%. The new data continues the trend of fewer uninsured that began with…

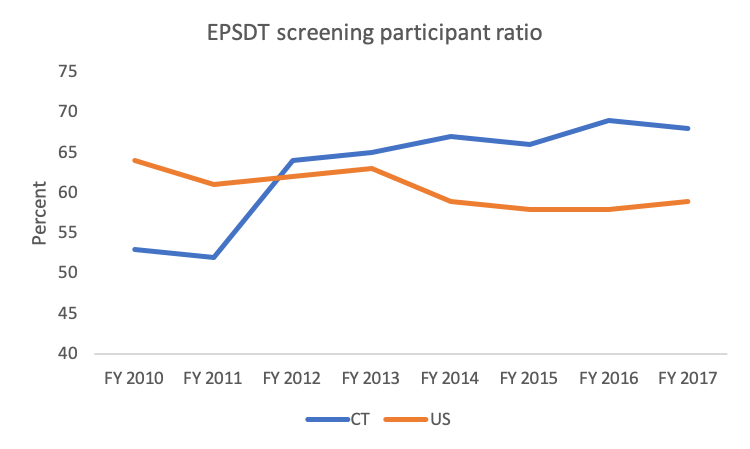

Read MoreCT Medicaid child checkup rates jumped when HMOs were fired

Well-child screenings increased twelve percent for HUSKY children between FY 2001 and FY 2012, according to a new report from the Government Accounting Office. While correlation is not causation, it is important to note that on January 1, 2012 Connecticut Medicaid payment shifted from capitation through private managed care companies to our current managed fee-for-service…

Read More2020 insurance premium requests increase lower for individuals on AccessHealthCT, most of whom are subsidized, older and higher risk

Connecticut insurers have filed their requests for individual and small group premium increases for 2020 with the CT Insurance Dept. Requests vary from an average reduction of 9.8% for CTCare individual plans outside AccessHealthCT, our state’s insurance exchange, to 22% average increases for Aetna small group plans also outside AccessHealthCT. Six in ten people in…

Read MoreCTNJ: CT doesn’t score well on healthcare – prices are to blame

A new state health ranking is out, and Connecticut trails the rest of New England. Connecticut’s big problem is the cost of our care. Our performance in health outcomes and access to care are passable, but we are 44th among states in the cost of care. Read more

Read More