CT medical debt levels declining, new state law will help even more

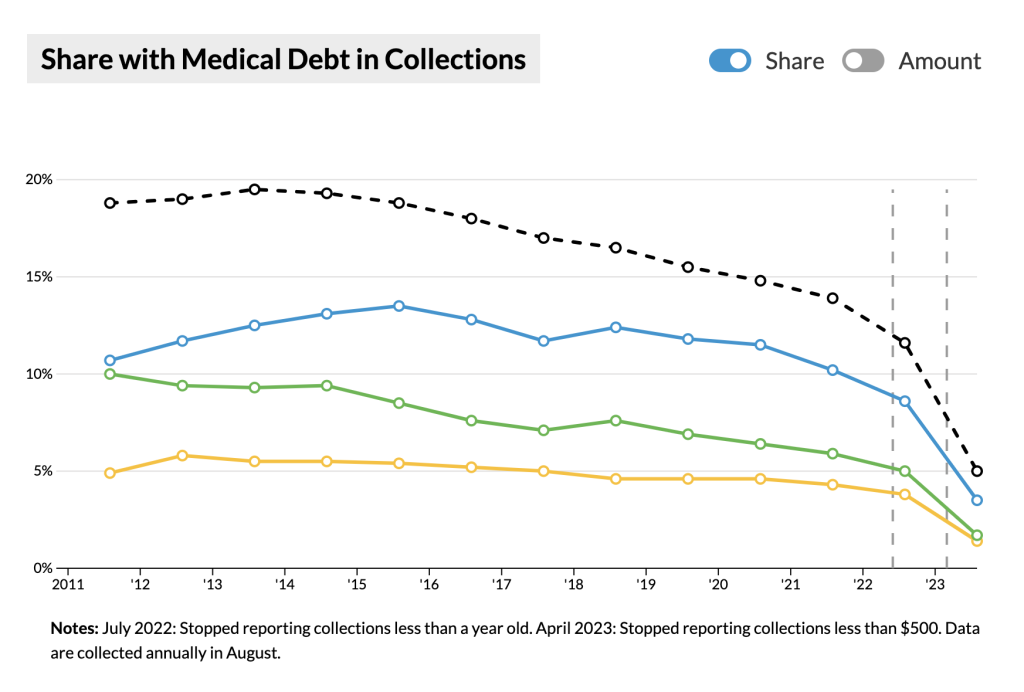

Lines: CT-blue, MA-yellow, NY-green, US-dotted black

The percent of Connecticut residents with medical debt is coming down, but it still affects one in 28 of us, according to a fascinating new tool from the Urban Institute. In a survey last year, 3.5% of Connecticut residents (blue line) reported they have medical debt that has been referred to collections, down from 8.6% the year before. This is below the US average (dotted black line – 5.0%) but well above our neighboring states of Massachusetts (yellow line – 1.4%) and New York (green line – 1.7%).

The large drop in 2022 resulted when the three national credit reporting companies changed how they report medical debt — paid medical bills were removed from credit reports, medical debt was removed from credit score calculations, the grace period for medical debt increased, and debt less than $500 was removed from consumer credit reports. More relief is coming for Connecticut residents with medical debt. Last month a state law passed that prohibits providers from reporting any medical debt to credit bureaus.

The Urban Institute tool also finds significant disparities in medical debt. Residents of Connecticut’s communities of color are 68% more likely to report medical debt that has been referred to collections.

The Urban Institute tool also finds considerable variation in medical debt between Connecticut counties. Surprisingly residents of Litchfield county, with the state’s third highest average per capita income, are the most likely to report medical debt in collections at 4.7%. And Fairfield county residents, with the highest average incomes are close behind with 4.1% reporting medical debt in collections. Middlesex county residents, with the fourth highest average incomes, are the least likely to report medical debt in collections.