Study finds CT private healthcare payment rates more than double Medicare’s, close to US average

A new study by RAND analyzing provider payments rates for commercial plans finds Connecticut’s 2022 rates averaged two and half times (258%) what Medicare would’ve paid for the same services at the same hospital (Relative Price). There was little variation by overall type of services. However, individual Connecticut hospitals varied considerably in Relative Price. There was no correlation between higher prices and higher quality, based on CMS quality star ratings. Contrary to common mythology, this study, like many others, found high commercial prices are not driven by cost shifting due to lower Medicaid and Medicare payments.

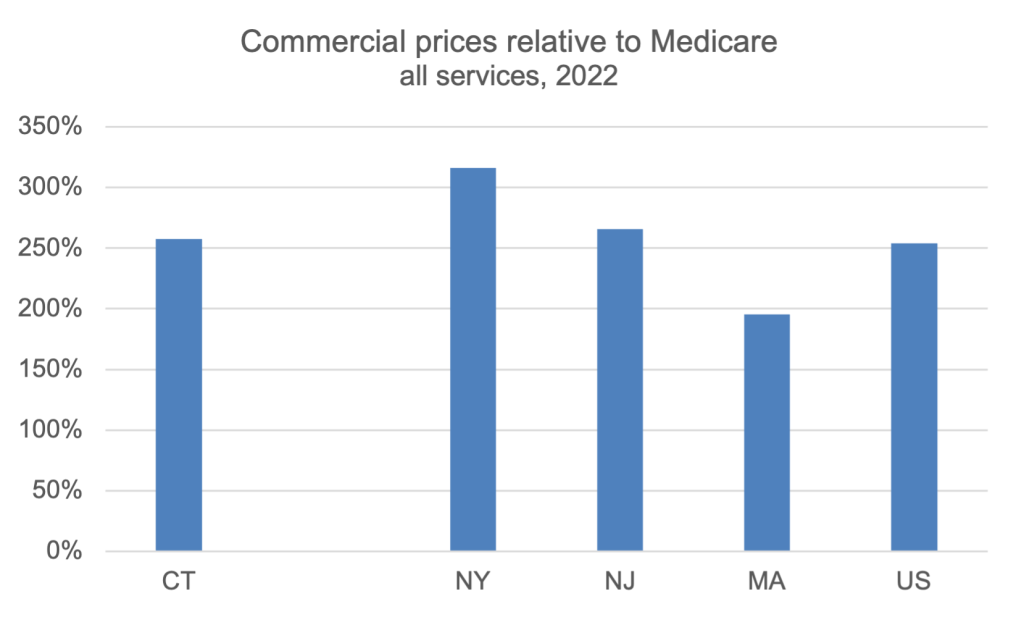

The newest RAND study found that in 2022, Connecticut’s commercial to Medicare Relative Price average was 23rd highest among states and very close to the national average (254%). Our Relative Price was below New York’s (316%), above Massachusetts’s (195%), and about the same as New Jersey’s (266%). If Connecticut had used Medicare payment rates for all commercial services, we would have saved $740 million that year.

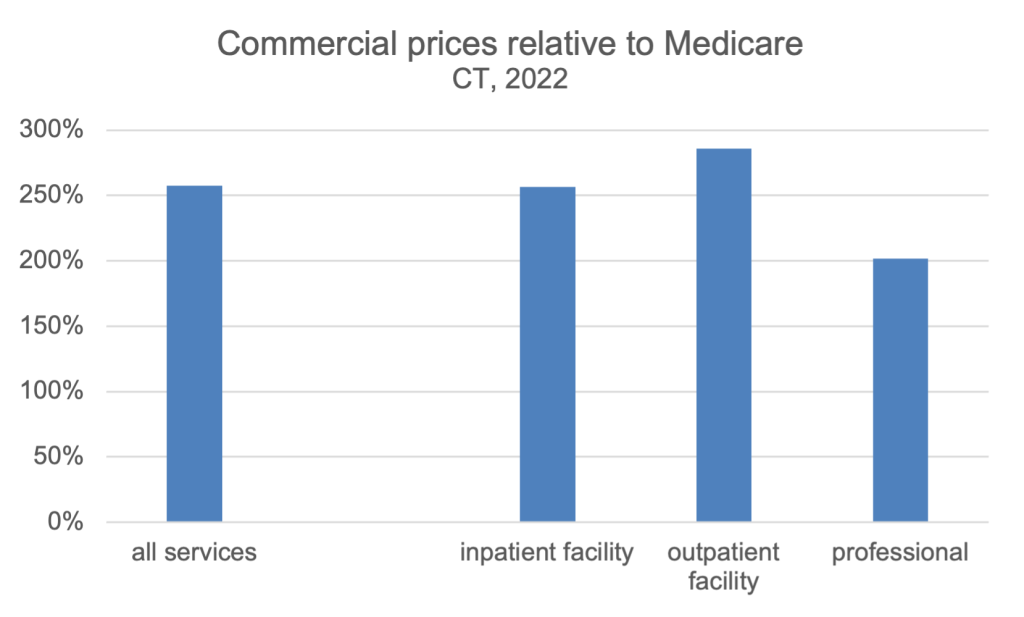

Among services, Connecticut’s Relative Price for overall types of services were very similar. Prices for outpatient facility services were highest relative to Medicare (286%), lowest for professional services (202%), and inpatient facility care prices were in between (256%).

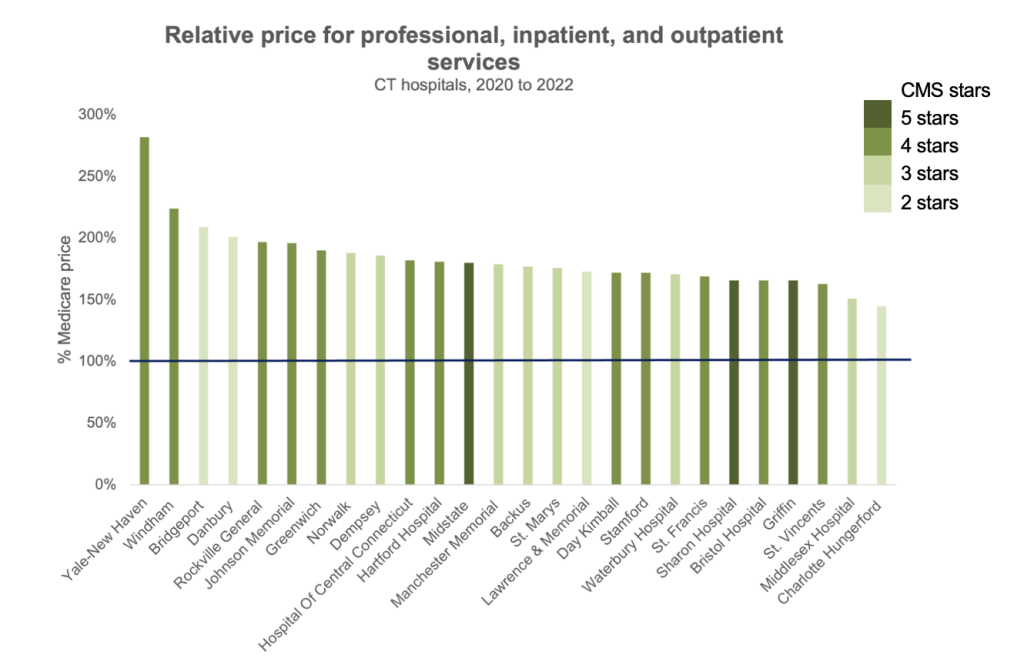

Between 2020 and 2022, there was great variation between Connecticut hospitals in Relative Price, but all exceeded the prices Medicare would have paid. Yale-New Haven’s prices were highest compared to Medicare (282%) while Charlotte-Hungerford’s were the lowest (145%).

Contrary to the conventional wisdom that you get more when you spend more – the study found that prices and quality of care were not correlated. Three Connecticut hospitals earned the highest CMS quality ranking of five stars, in darkest green bars in the chart. But in Relative Price, they ranked 12th highest among the state’s 26 hospitals (Midstate), 21st (Sharon), and 23rd (Griffin). While four hospitals earned only two quality stars, the lightest green, they ranked 3rd highest in Relative Price (Bridgeport), 4th (Danbury), 16th (Lawrence & Memorial), and 26th (Charlotte Hungerford).

Also contrary to common mythology, this study found high commercial prices were not driven by cost shifting caused by lower Medicaid and Medicare payments, as have many previous studies. Higher prices are driven by consolidation and market power. According to the authors, “Very little variation in prices is explained by each hospital’s share of patients covered by Medicare or Medicaid; a larger portion of price variation is explained by hospital market power.”