State Partnership Plan losing money but still more expensive than average CT plan options

Connecticut’s most recent public health insurance option, the Partnership Plan 2.0, offers healthcare coverage to municipal employees. According to a new analysis by Brown & Brown Insurance, Partnership Plan premium increases have not kept up with costs. The very impressive analysis is based on Freedom of Information requests; very little information on the Partnership Plan or the State Employment Plan are available publicly. In FY 2019, the plan had a deficit of $31.9 million, up from $10.1 million in FY 2018. State taxpayers have covered those losses. Despite that, Partnership Plan premiums are higher than other plans offered in Connecticut.

Legislators are now considering the Partnership Plan as the foundation for another public option to cover nonprofits, small businesses, and unions.

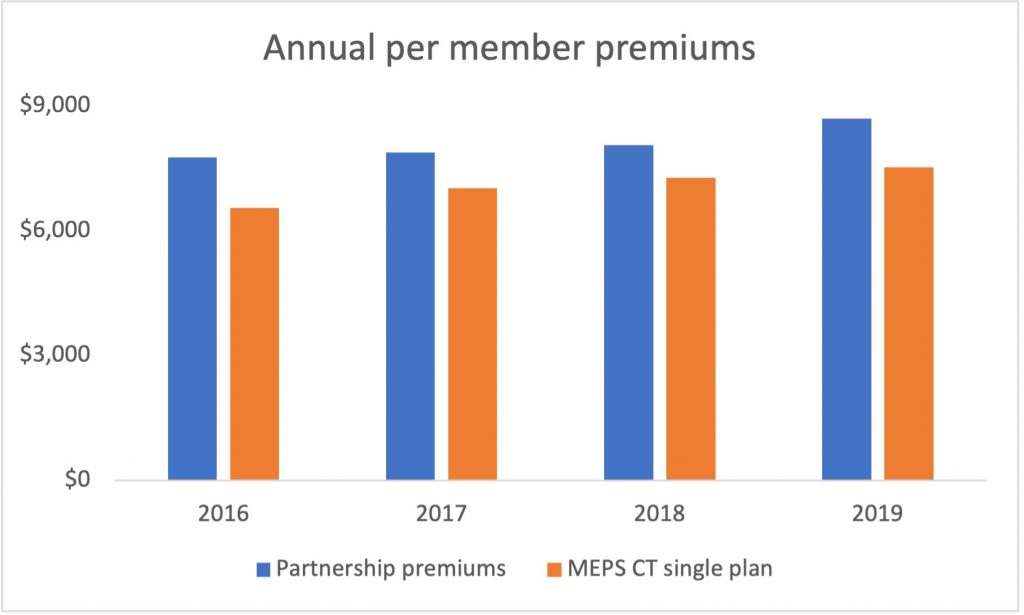

From 2016 through 2019, Partnership Plan per member premiums have consistently been more expensive than single insurance plans available in Connecticut, as much as $1,212 more per person in 2016.

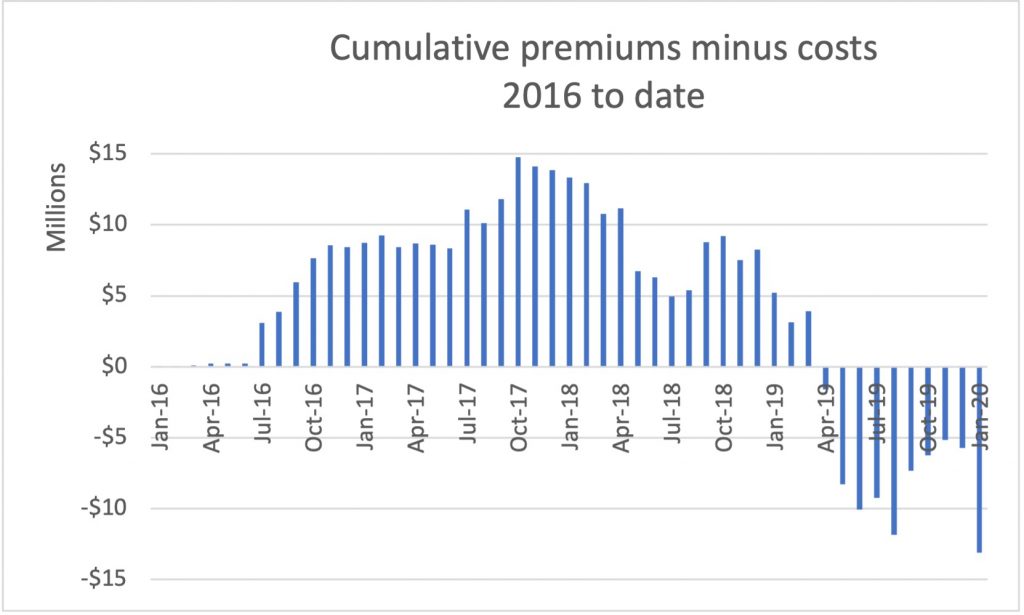

From 2016 through early 2019 the fund was healthy, covering medical and administrative costs with premiums. However, in early 2019, premiums began running behind the costs of care and the fund became unbalanced.

It is estimated that premiums would have to increase 18.57% to cover the base costs of the plan in 2021 to 2022. To also include a reserve fund to cover runout claims, typical for self-funded plans, would require a 25.00% increase in premiums. But preliminary increases for the FY 2022 year are 3.0%, increasing the gap between premiums and claims.

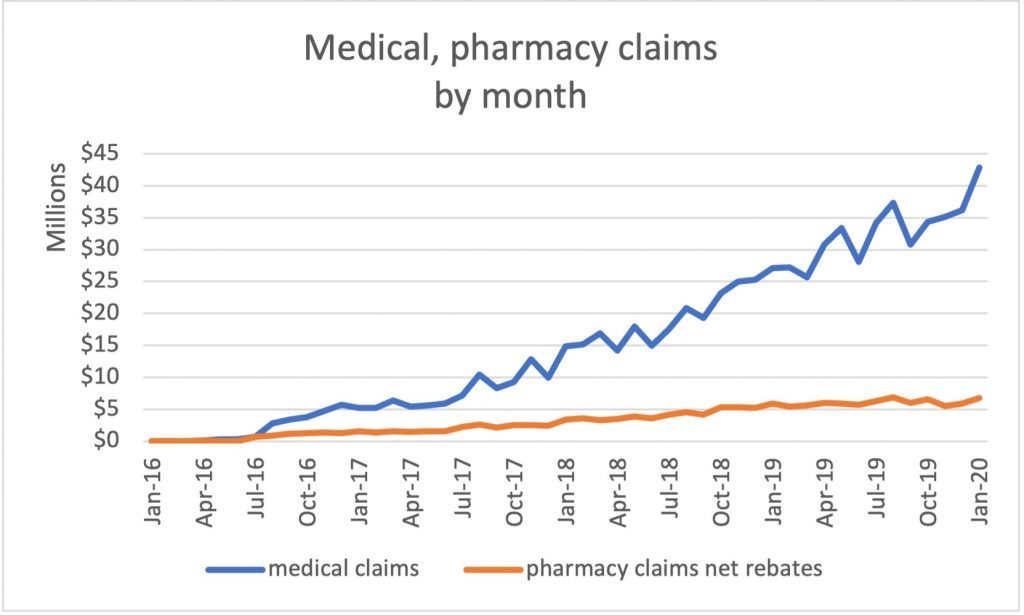

Cost increases in the Partnership have been mainly in medical care. Pharmacy costs are relatively stable.

The report notes that the Partnership’s higher costs of care are likely because the rates are posted online. Only groups with current costs above those rates are likely to join. Groups getting a better bargain are likely to stay with their lower cost plan.

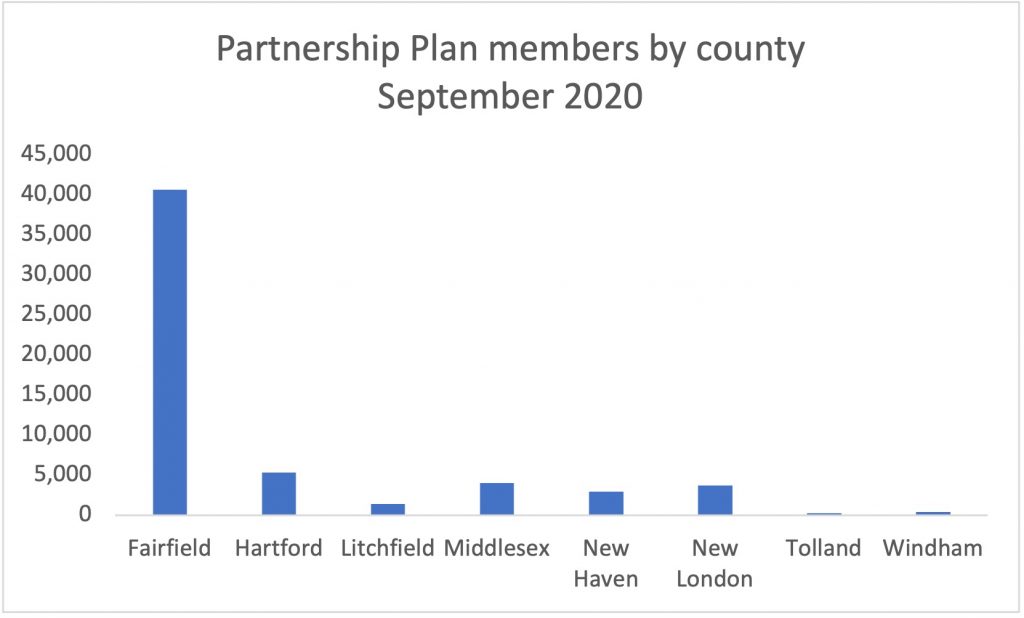

The rising costs of claims in the Partnership Plan are “due in large part to an influx of membership from Fairfield County” where healthcare is more expensive. Enrollment from Fairfield county has risen almost four-fold since 2016. As of September of last year, 70% of the Partnership’s enrollment was from Fairfield County.

Because the COVID pandemic has significantly affected healthcare spending and the eventual impact is uncertain, we only include data from before the pandemic.