Connecticut deductibles are high and rising, but premiums are rising more slowly

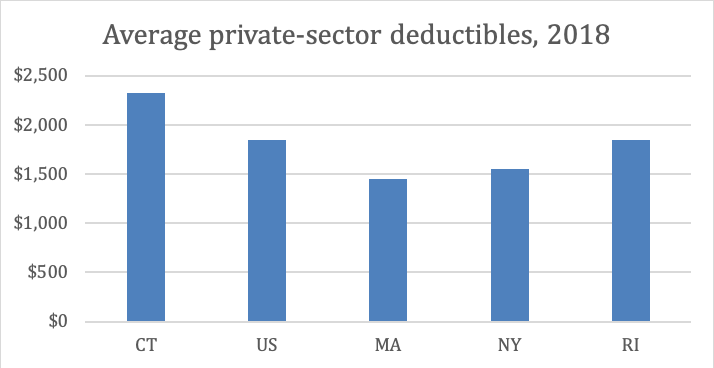

New numbers from the 2018 US Medical Expenditure Panel Survey finds that deductibles for private-sector health insurance in Connecticut are high at $2,322 for single coverage and $3,784 for families, the 3rd and 9th highest among states respectively. Deductibles more than doubled between 2008 and 2018 both in Connecticut and the nation.

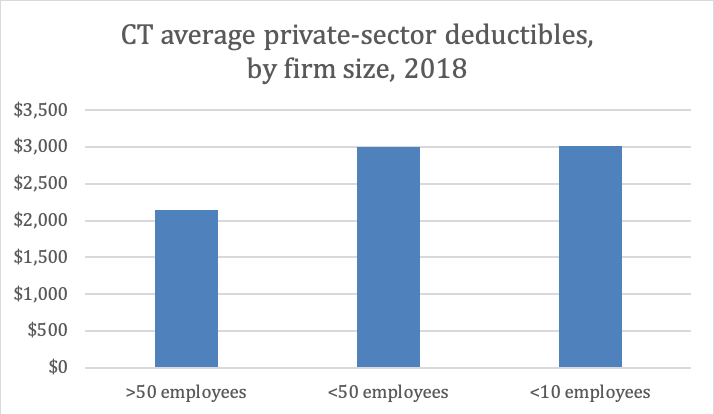

Deductibles for workers at small businesses were significantly higher than for workers at large companies. Even with higher deductibles, total premiums for businesses with under ten employees were 16% higher than for companies with over fifty workers.

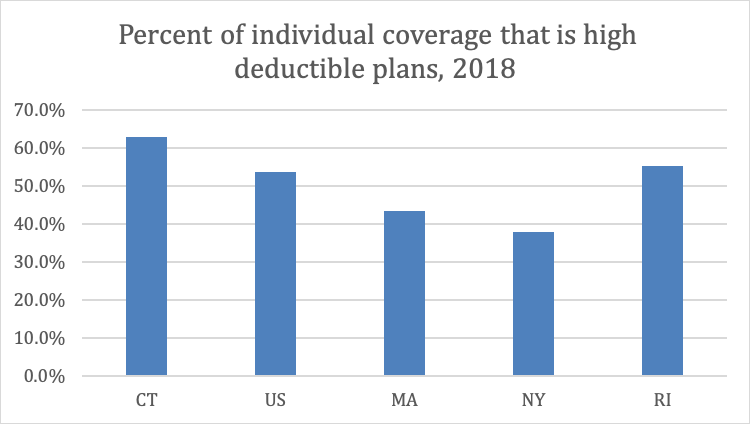

The rise in deductibles is likely related to the emergence of high-deductible health plans, which are more prevalent in Connecticut than all but eight other states. High deductible plans cover 63% of state residents with single plans and 55% of families last year. The number of Connecticut workers in high-deductible health plans grew from 2017 to 2018. Barely half (49.2%) of Connecticut employers offering high deductible individual plans contribute to workers’ health savings accounts, compared to 65.7% in Massachusetts.

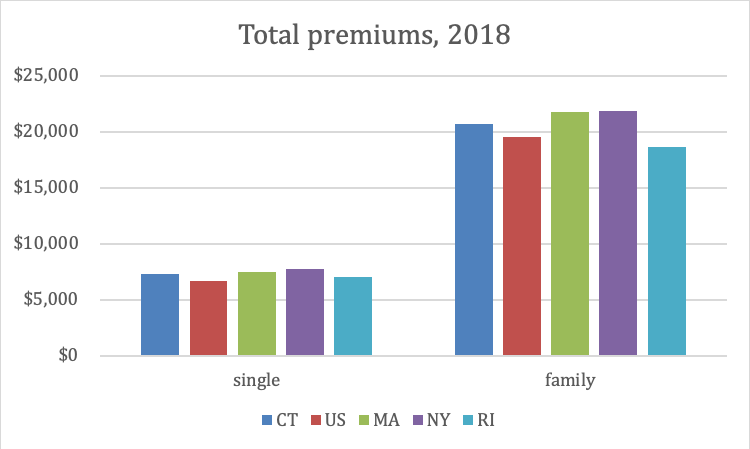

At $7,264 for single and $20,735 for families, total 2018 private-sector health insurance premiums are slightly higher in Connecticut than the US average. On average, Connecticut employees paid 23% of single and 26% of family premiums in 2018, similar to national averages and our surrounding states.

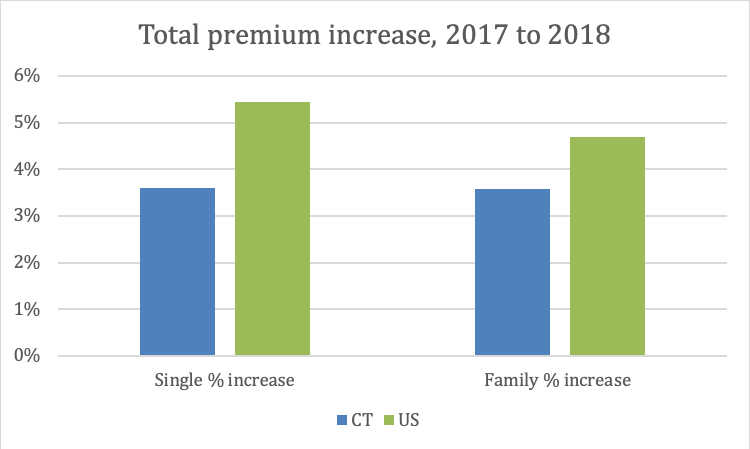

However, both single and family premiums in our state are growing more slowly than the national average.

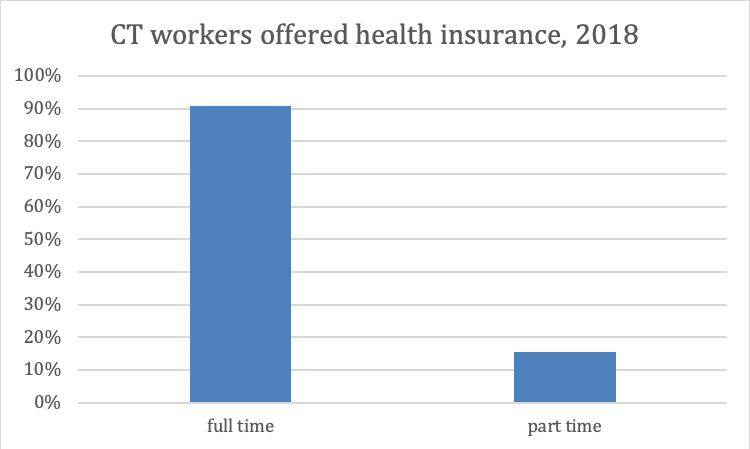

Connecticut full time workers are six times more likely than part time workers to be offered health insurance by their employers. One in ten Connecticut employers offer health benefits to retirees, similar to national averages.

Source: 2018 MEPS Insurance Component Survey, Agency for Healthcare Research and Quality, HHS, https://www.meps.ahrq.gov/mepsweb/