providers

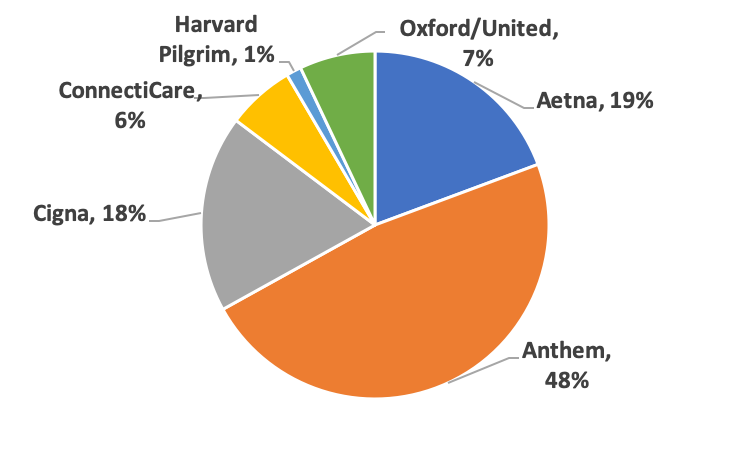

CT insurers lost enrollment in 2018, Spent 89% of premiums on medical care

There were 332,015 fewer Connecticut residents with commercial insurance coverage last year than in 2017, according to the latest Consumer Report Card from the CT Insurance Department. All insurers lost enrollment. The report also includes important information for consumers including member satisfaction performance, numbers of participating providers by county, medical measures such as cancer screens,…

Read MoreThirty medically complex children stuck in CT hospitals waiting for home health care cost state over $100 million

Last week, MAPOC’s Complex Care Committee heard from the three remaining home health agencies that provide care for Connecticut’s most medically complex children. We heard about the massive challenges facing both families and agencies. Most parents caring for medically complex children are single mothers due to high divorce rates, who cannot work because of inconsistent…

Read MoreCT healthcare price variation varies

Prices vary by city and for selected healthcare treatments, in some cases substantially, according to Healthscore CT, using the new All Payer Claims Database from the CT Office of Health Strategy and UConn Analytics and Information Management Solutions. The site provides important information on cost and quality for consumers and payers shopping for healthcare services…

Read MoreCTNJ: A recession is coming and it could hit Connecticut healthcare hard

While President Trump disagrees, a recent survey found that three in four economists expect the US economy to enter a recession by 2021. Recessions are a natural part of the economic cycle – it’s not a question of whether it will happen, but when. The last recession, in 2008, hit Connecticut especially hard, and in…

Read MorePCMH + risk scores suggest possible gaming or worse; Advocates call on DSS to delay expansion to protect members and taxpayers

A new analysis of PCMH + members’ risk scores finds unexplained increases compared to the control/comparison group that could signal ACO gaming of the system for financial gain and/or, far worse, a decline in the health of members in the program. PCMH Plus, a controversial new payment model, allows ACO (large health systems) to share…

Read MoreAs provider shortages grow, salaries are up, Eastern physicians lag behind rest of US

From 2017 to 2018 total compensation rose 3.4% for primary care physicians and 4.4% for specialists across the nation, according to Physicians Practice. Total provider compensation rose between 7 and 11% over the last five years. The highest increasing specialty from 2017 to 2018 was 7.71% for diagnostic radiology. Physician assistants’ and nurse practitioners’ total…

Read MoreCoincidence? CT spends little on primary care, and we have high ED, preventable hospitalization rates

A new analysis finds that Connecticut, at only 3.5% of our health care dollars spent on primary care, is last among 29 states studied. Not surprisingly, we also rank among the highest in ED visits, all hospitalizations, and in avoidable hospitalizations. The US average is 5.6% of health care spending devoted to primary care, well…

Read MoreAging CT healthcare workforce raises concerns about loss of expertise and capacity

Connecticut’s workforce is getting older, including healthcare, according to a new analysis by the state Dept. of Labor. This raises concerns about retirements, a loss of expertise, and capacity which could hit Connecticut hard. The share of all workers over age 54 rose from 20% in 2008 to 26.5% in the third quarter of last…

Read MoreComments needed on federal proposal to erode medical debtors’ rights

The National Consumer Law Center is asking people who care to submit public comments on the US Consumer Financial Protection Bureau’s proposed debt collection rule. Medical bills are the biggest cause of bankruptcy and the top reason for contact by collections. Unfortunately, that burden falls very heavily on Connecticut residents. Health insurance premiums for both…

Read MoreLarge study finds selection bias in Medicare shared savings erases savings and quality improvements – advocates saw this coming

Researchers from the University of Michigan found that the modest savings and quality improvements reported by Medicare’s extensive shared savings program (MSSP) are likely due to adverse selection. High cost clinicians and beneficiaries were far more likely than others to exit the program. When adjusted for the selective bias in MSSP exit, reported savings and…

Read More