CT employee insurance costs up, but total picture is more complicated

Worker costs for health insurance are growing in all states, including Connecticut, both in total dollars and as a proportion of median incomes, according to a new analysis by the Commonwealth Fund. Connecticut has not been hit as hard as other states, because in the past growth in median income here was strong. But that is changing. I’m not sure how many turns this paragraph took, so let’s break it down.

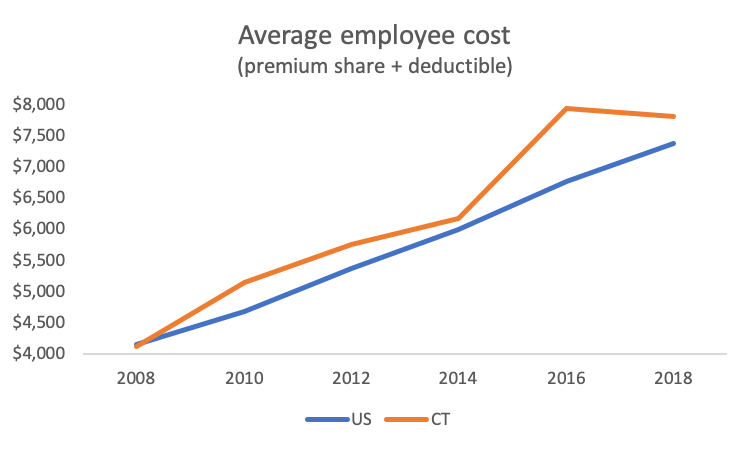

If you’ve heard and experienced that premiums and deductibles are high here in Connecticut, you’re not wrong. Connecticut deductibles have been higher than the US average since at least 2008. We were third highest in the nation in 2018. Average premiums in Connecticut were the sixth highest among states in 2018. Connecticut, in orange in the graph, is above the US line, in blue.

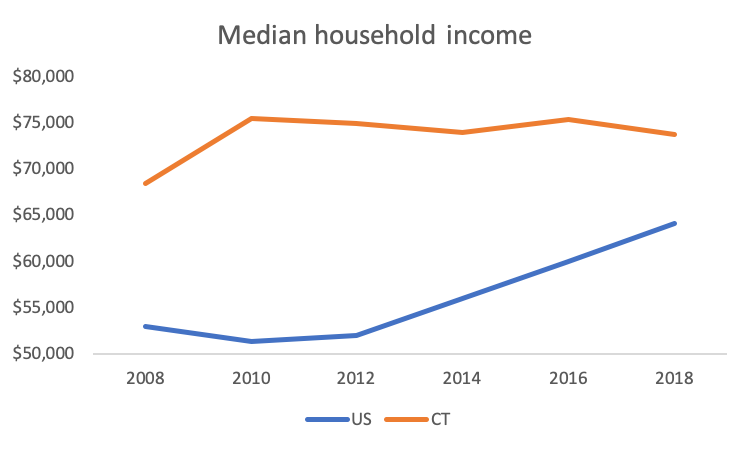

If you’ve heard that Connecticut is a relatively wealthy state, you’re also not wrong about that. In 2012, our median household income was tied with New Hampshire for the highest in the nation. Unfortunately, we haven’t held that ground. We dropped to fifth in both 2014 and 2016 and were down to 12th in 2018. Since 2010, Connecticut’s median incomes have slowly declined while the national average is growing. Connecticut is still well above average, but not moving in the right direction.

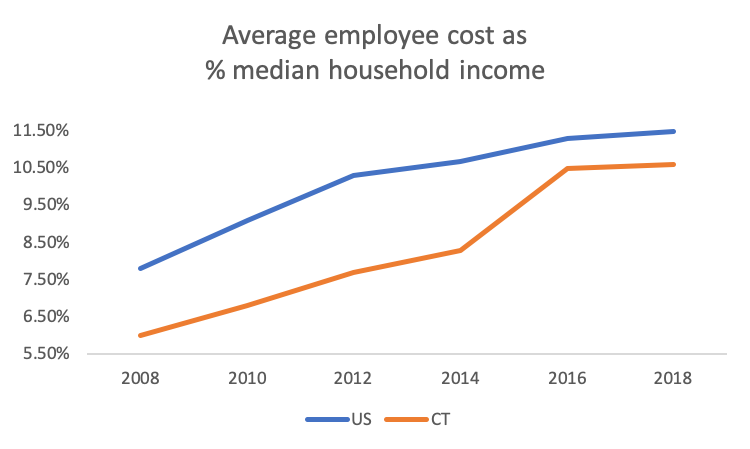

Unfortunately, together this isn’t trending well for affordability of employer-sponsored coverage in Connecticut. In 2018, at 10.6% of median income, total employee deductibles and share of premium is below the national average of 11.5%, but we are catching up.

Bottom line: Insurance costs for employees is growing in Connecticut and our wages aren’t keeping up. The problem is not only lowering the total cost of coverage, but also improving the state’s economy so we can afford care.