CT insurers lost enrollment in 2018, Spent 89% of premiums on medical care

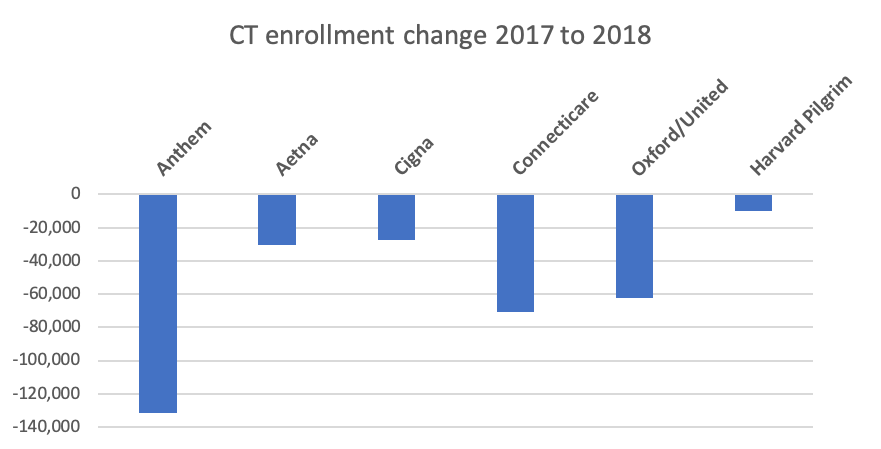

There were 332,015 fewer Connecticut residents with commercial insurance coverage last year than in 2017, according to the latest Consumer Report Card from the CT Insurance Department. All insurers lost enrollment.

The report also includes important information for consumers including member satisfaction performance, numbers of participating providers by county, medical measures such as cancer screens, how well they control patients’ high blood pressure, access to primary care and behavioral health care. Claims paid per member per month by general category by plan are also included.

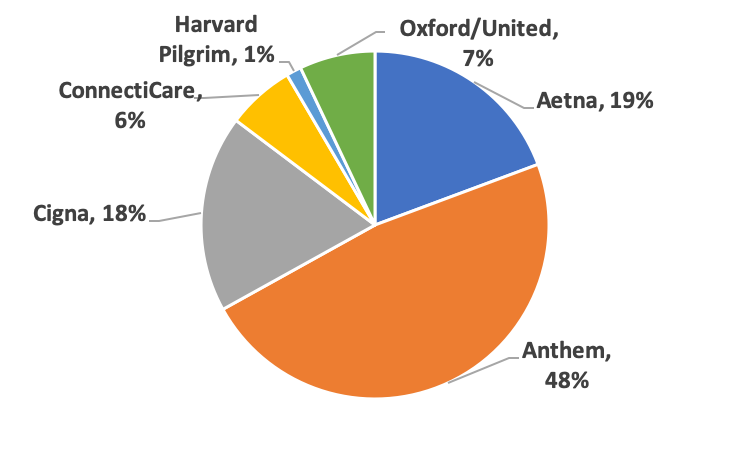

The relative market shares of insurers didn’t change much with Anthem retaining almost half the market in 2018.

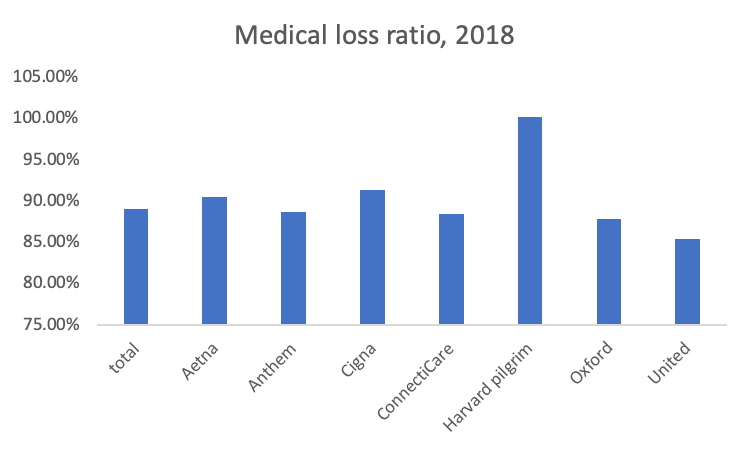

The statewide 2018 Medical Loss Ratio (MLR), the percent of premiums insurers pay out for medical bills, was 89%. By insurer, MLRs varied from 85.4% for United to 100.2% for Harvard Pilgrim.

Note: Only plans with over 5,000 enrollment were included. MLRs were weighted by plan enrollment.